(1/1/14 – 12/31/15), PIs: Oleg V. Pavlov (WPI), Khalid Saeed (WPI), Lawrence W. Robinson (Cornell University

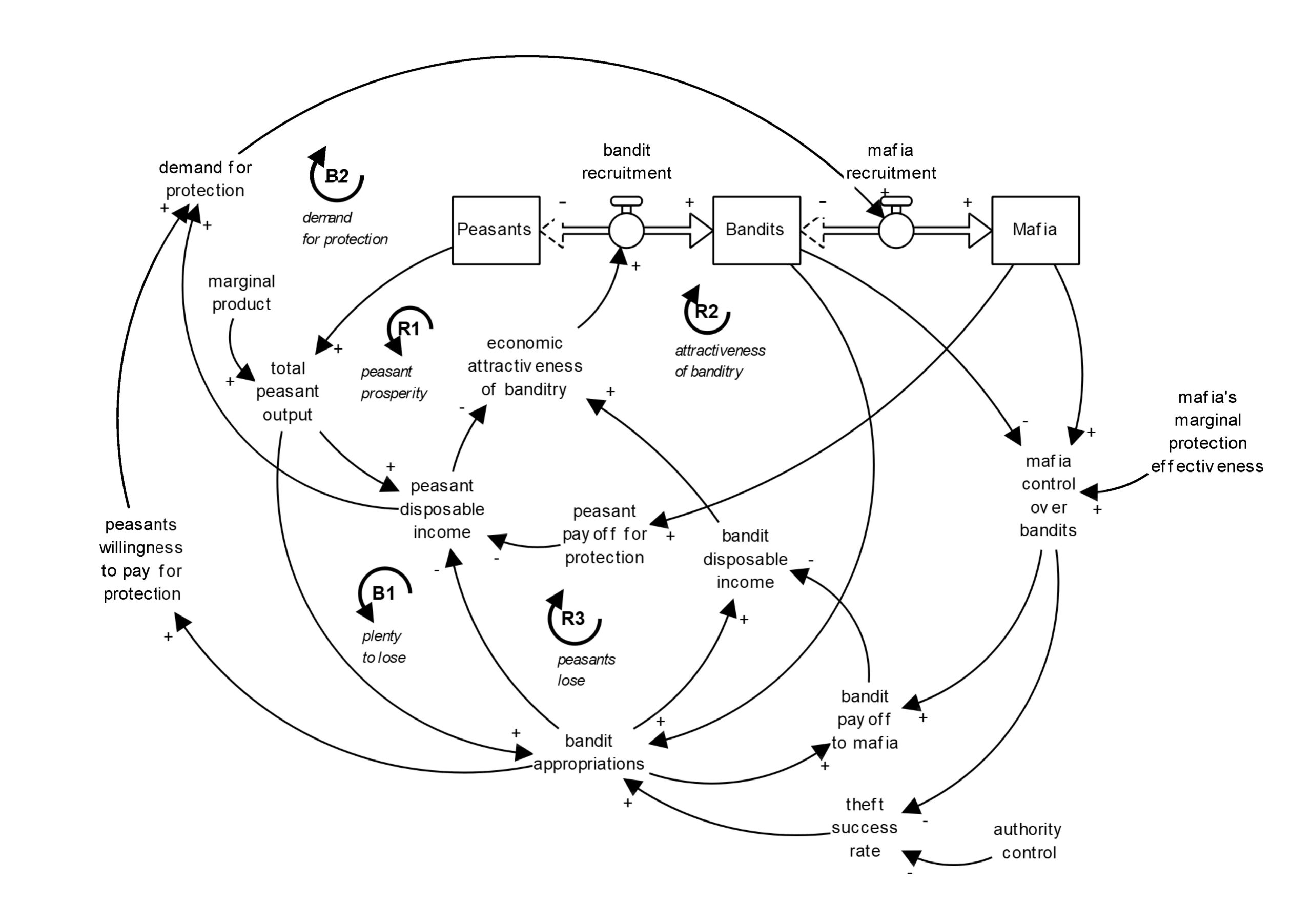

Research shows that learning and task performance improve when participants in management exercises understand the structure of the system they control. However, the majority of business simulators are “black-boxes.” This article introduces structural debriefing, which is a debriefing activity aimed at helping students learn about causal relationships, feedbacks, accumulations and delays within a black-box simulation. A structural debriefing can be prepared and facilitated by following the Structural Debriefing Protocol. A pilot study was conducted in which undergraduate students participated in a structural debriefing of The LITTLEFIELD TECHNOLOGIES, a popular simulation for teaching principles of operations management. The students were able to complete all eight steps of a structural debriefing, but required considerable time (three academic terms) to do so. Not every instructional simulation will require all the steps or such a large time commitment. The successful completion of the pilot study demonstrates that structural debriefing is a useful debriefing technique. However, to be effective, the scope and format of a structural debriefing activity must suit practical and pedagogical considerations.

Continue reading →